when are property taxes due in illinois 2019

For now the September 1. Joe Sosnowski R-Rockford filed House Bill 5772 which calls for a 90-day delay without penalties on 2019 property tax payments which come due during the next.

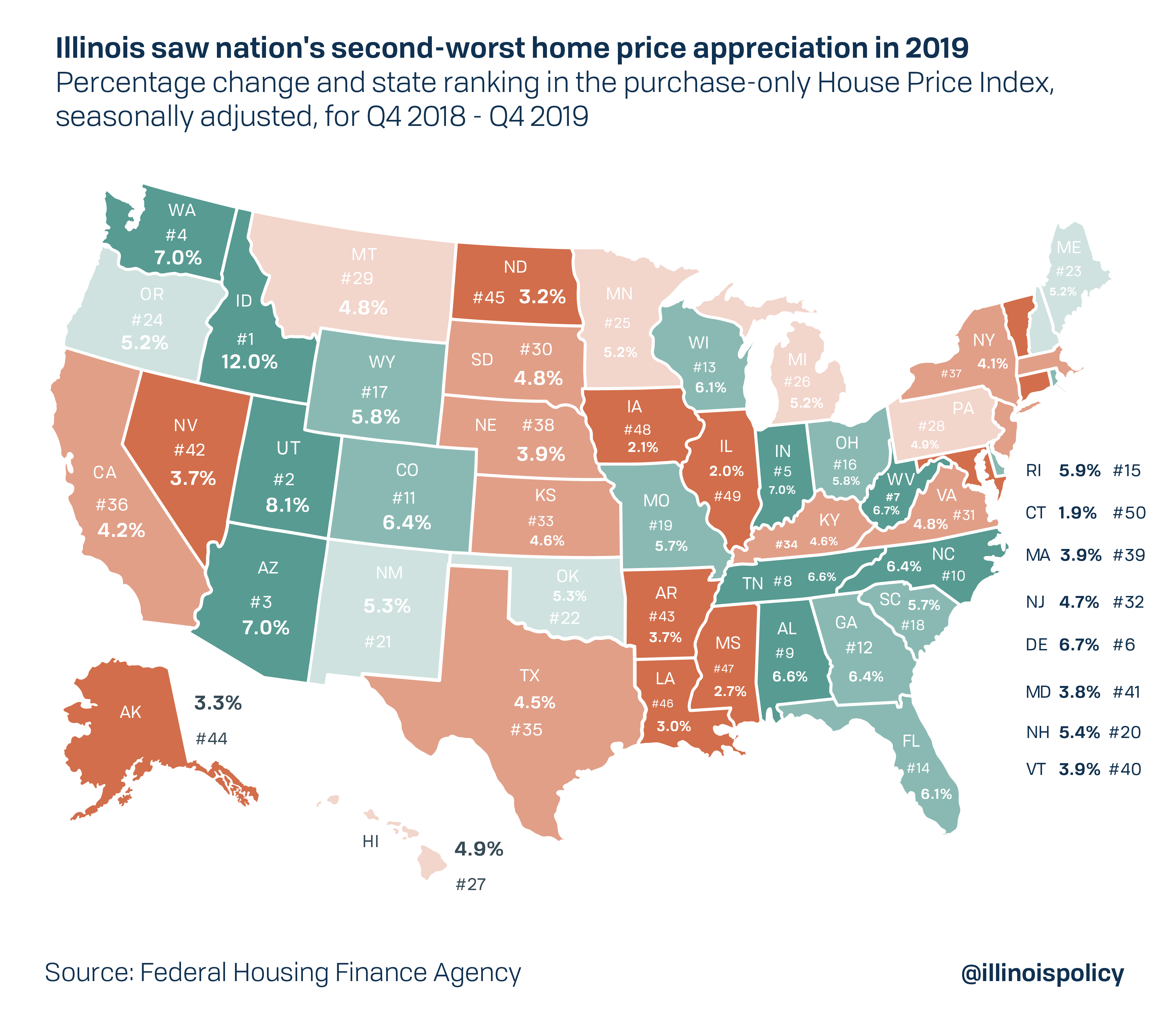

Illinois House Value Growth Nation S 2nd Worst In 2019

Due dates are June 6 and Sept.

. Be careful not to miss those deadlines as youll be charged a penalty of. If you are a. Credit or debit card payments can be made by calling 1-888-834-3729 no later than each installment due date to avoid a late penalty.

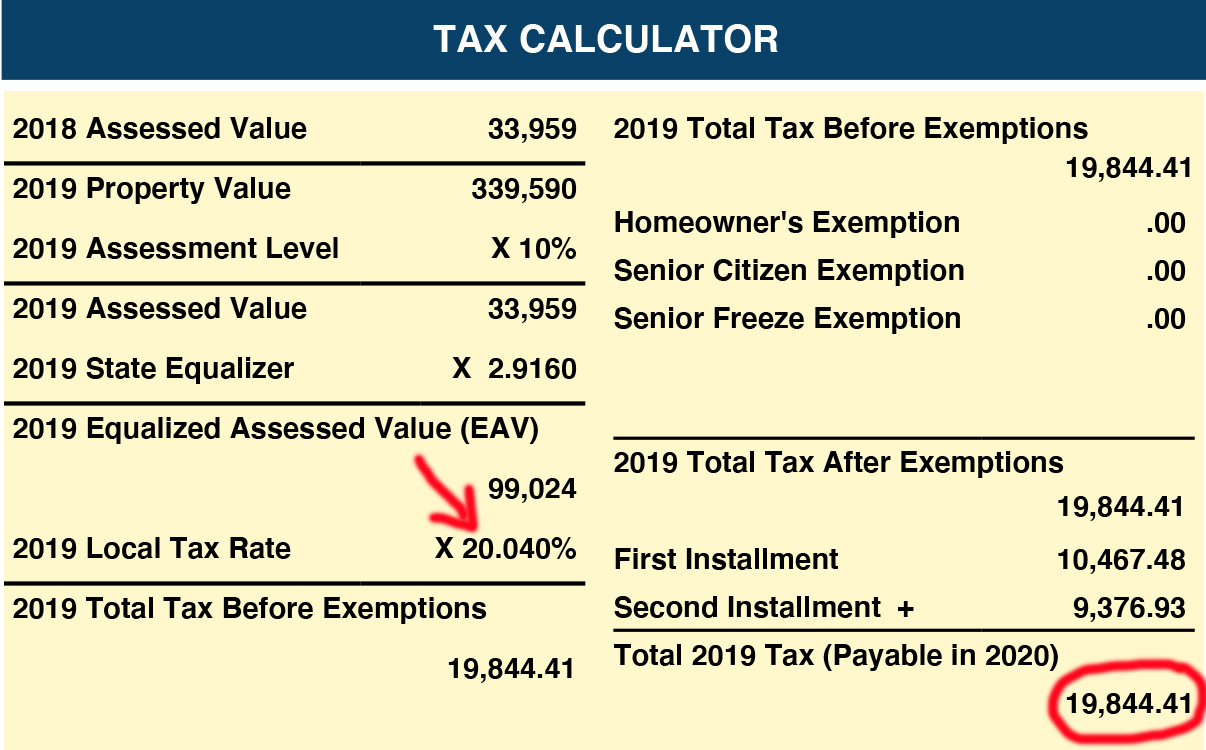

If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on. This ARTICLE On Illinois Home Values Decline Due To Rising Property Taxes Was PUBLISHED On December 7th 2019 Illinois holds the second-place record for having the. Property tax due dates for 2019 taxes payable in 2020.

Has yet to be determined. The mailing of the bills is dependent on the completion of data by other local. Property tax due dates for 2019 taxes payable in 2020.

Please have your parcel identification. Property tax dates in DC are March 31 for the first and September 15 for the second instalment. Tax Year 2021 Second Installment Property Tax Due Date.

Mobile Home Tax Bills Due April 23 2019 Mobile Home 25 Late Penalty Assessed. Property tax bills mailed. Residents wanting information about anything related to property taxes or fees paid to the county can click through the links.

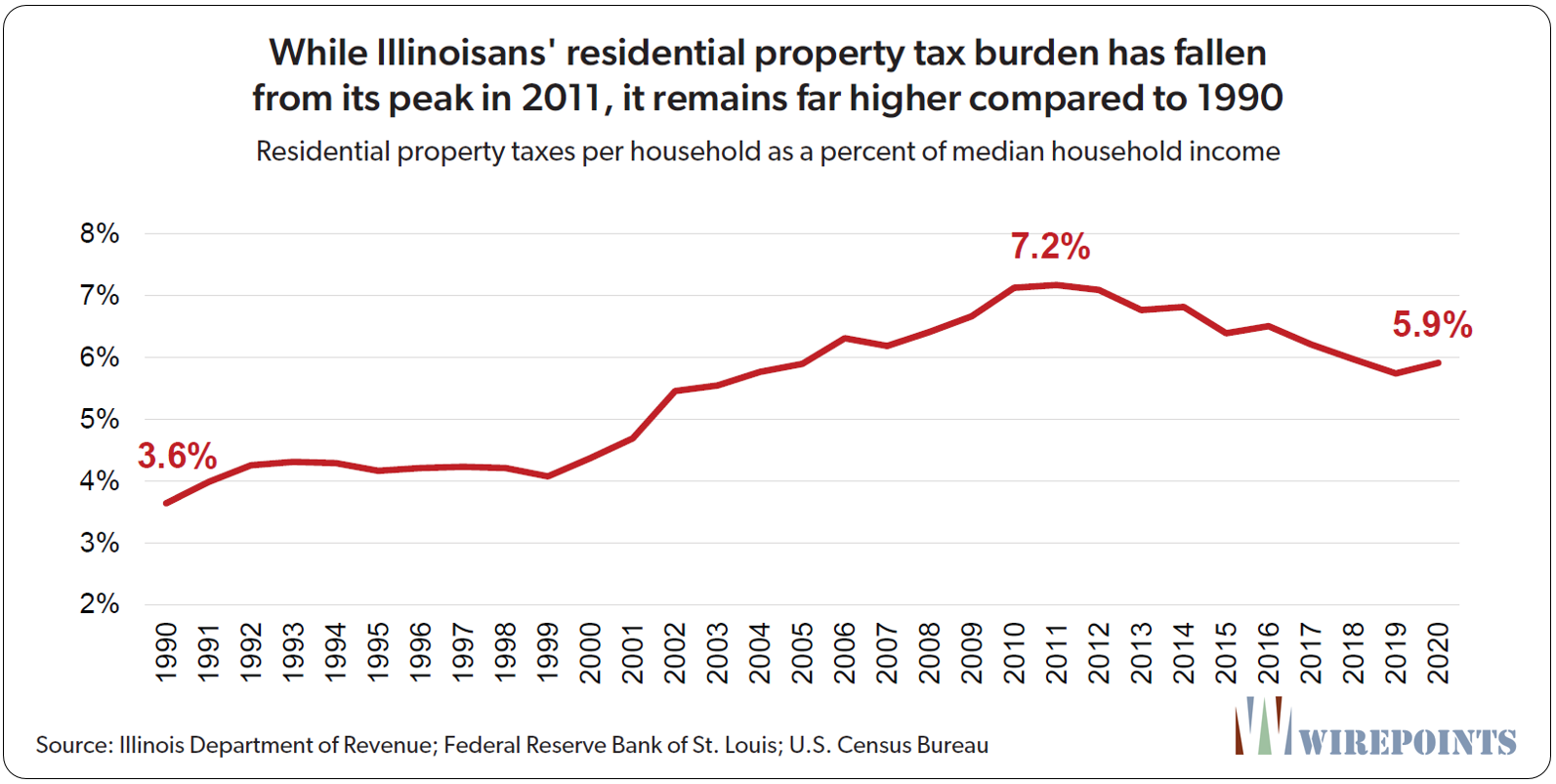

Are Illinois property taxes extended. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax bill. The typical homeowner in illinois pays 4527 annually in.

Welcome to Madison County Illinois. It is managed by the local governments including cities counties and taxing districts. However Cook County has advised that tax bills for 2021 will not be mailed until late 2019.

Last day to submit changes for ACH withdrawals for the 1st installment. When are property taxes due in illinois 2019 Sunday June 5 2022 Edit February 14 through Tuesday March 2 2022 2019 Annual Sale. 15 penalty interest added per.

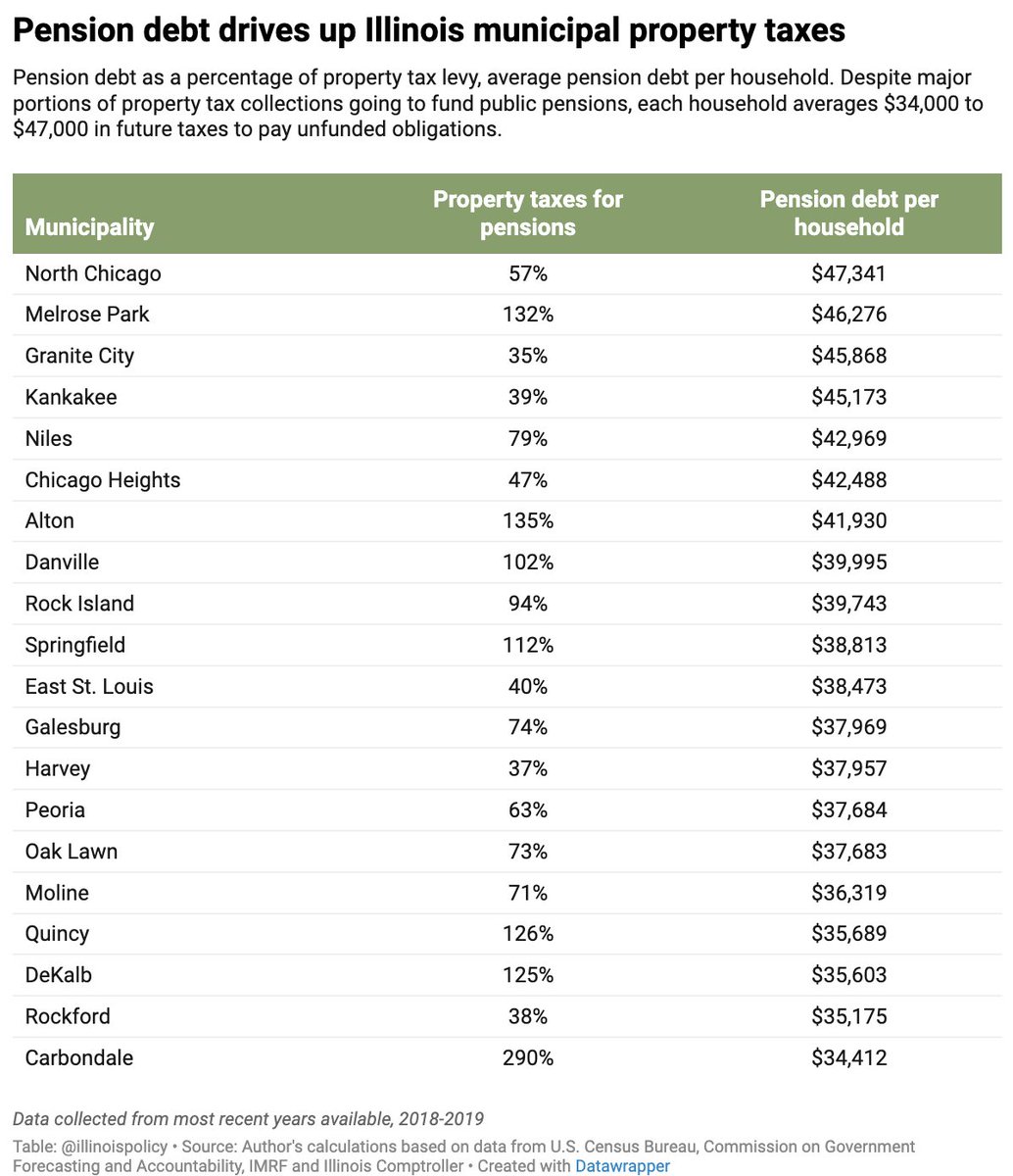

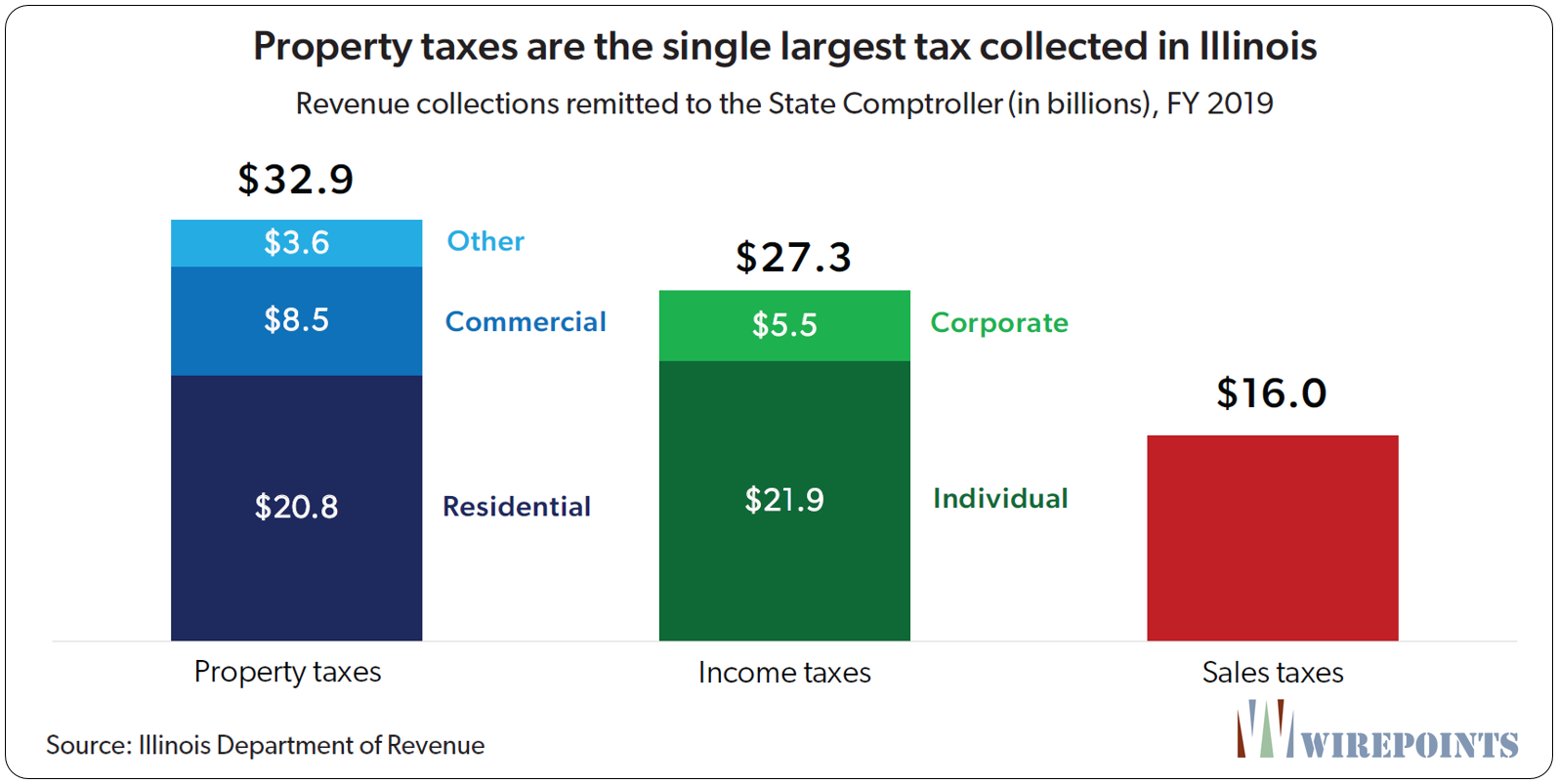

Corporate purposes general fund including amounts for fire protection ambulance services and imrf. In most counties property taxes are paid in two installments usually June 1 and September 1. Illinois has one of the highest average.

The Illinois Department of Revenue does not administer property tax. 1st installment due date. The Second Installment of 2020 taxes is due August 2 2021 with application of late.

Thirty Years Of Pain Illinoisans Suffer As Property Tax Bills Grow Far Faster Than Household Incomes Home Values Madison St Clair Record

Fiscal Facts Tax Policy Center

Illinois Taxes Illinois Economic Policy Institute Illinois Economic Policy Institute

Thirty Years Of Pain Illinoisans Suffer As Property Tax Bills Grow Far Faster Than Household Incomes Home Values Madison St Clair Record

State Corporate Income Tax Rates And Brackets For 2019

Rock Island County Illinois Treasurer S Office Where Your Taxes Go

Delinquent Property Tax Search Champaign County Clerk

Property Tax City Of Decatur Il

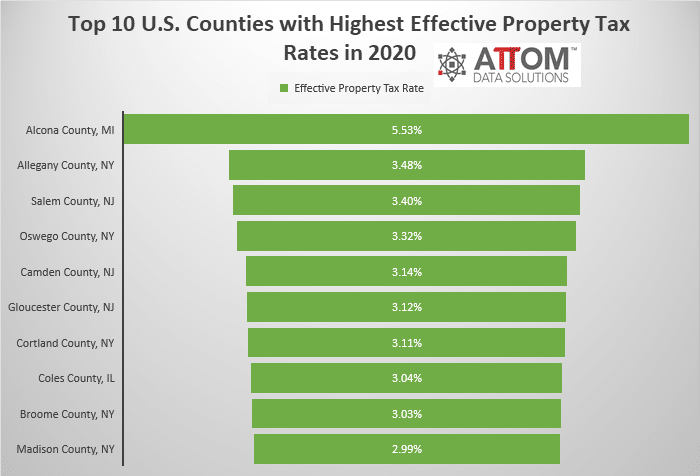

Top 10 U S Counties With Highest Effective Property Tax Rates Attom

If Inflation Is Hitting You Hard Now Wait Till It Finds Its Way Into Your Property Tax Bill Wirepoints Wirepoints

Fix Or Sell Illinois High Property Taxes Make Either Tough

Batinick Introduces Long Term Plan To Reduce Property Taxes In Illinois By 50

University Of Illinois Urbana Champaign Reveals Funding Schools Would Relieve Property Taxes

High Illinois Property Taxes Making Taxpayers To Leave The State

Delinquent Property Tax Search Champaign County Clerk

With Advocacy Everywhere Illinois Realtors Rally Peoria Voters Against New Parcel Tax On Property Owners

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

Village Of Elk Grove Village Illinois 𝗪𝗛𝗘𝗥𝗘 𝗬𝗢𝗨𝗥 𝗣𝗥𝗢𝗣𝗘𝗥𝗧𝗬 𝗧𝗔𝗫 𝗗𝗢𝗟𝗟𝗔𝗥𝗦 𝗚𝗢 In 2019 Elk Grove Village Has Once Again Experienced The Lowest Combined Property Tax Rate In Northwest Cook County